A steep drop within the US tight oil rig rely, falling standard manufacturing and sluggish oil demand will crush the US vitality dominance agenda.

US vitality dominance is over. Output might be going to drop by 50 p.c over the following yr and nothing will be performed about it. It has nothing to do with the shortage of shale profitability or different foolish memes cited by individuals who don’t perceive vitality.

It’s due to low rig rely.

The US tight oil or shale rig rely has fallen 69 p.c this yr from 539 in mid-March to 165 final week. Tight oil manufacturing will decline 50 p.c by this time subsequent yr. In consequence, US oil manufacturing will fall from to lower than eight mmb/d by mid-2021.

What if rig rely will increase between every now and then? It received’t make any distinction due to the lag between contracting a drilling rig and first manufacturing.

The celebration is over for shale and US vitality dominance.

Vitality Dominance is Over

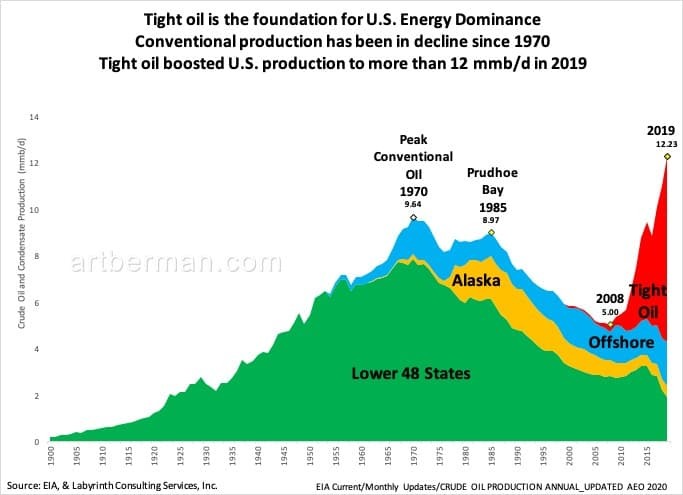

Tight oil is the muse of US vitality dominance. The US has all the time been a serious oil producer however it moved into the highest tier of oil tremendous powers as tight oil boosted output from about 5 to greater than 12 mmb/d between 2008 and 2019 (Determine 1).

Typical manufacturing has been declining since 1970. It fell from nearly 10 mmb/d in 1970 to five mmb/d in 2008. Tight oil boosted US manufacturing to greater than 12 mmb/d in 2019.

Determine 1. Tight oil is the muse for US Vitality Dominance

Tight Oil Rig Rely and Oil Manufacturing

Rig rely is an efficient solution to predict future oil manufacturing so long as the correct leads and lags are included.

It takes a number of months between an upward value sign and a signed contract for a drilling rig. It takes one other 9-12 months from beginning a effectively to first manufacturing for tight oil wells. With pad drilling, normally all wells on the pad have to be drilled earlier than bringing in a crew to frack the wells.

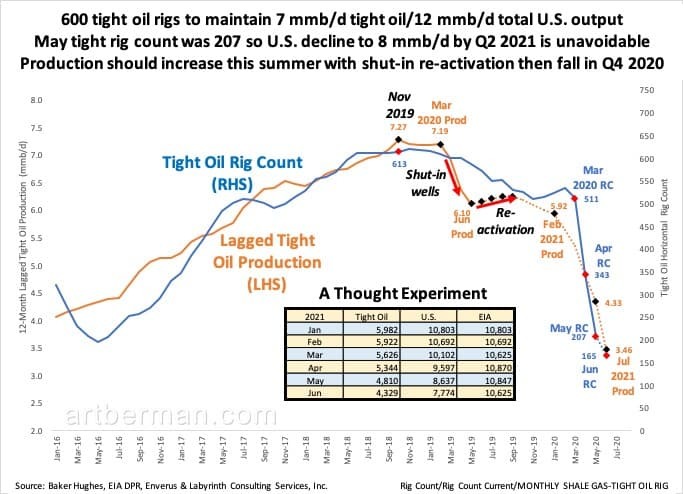

Tight oil horizontal manufacturing reached 7.28 mmb/d in November 2019 when the lagged rig rely was 613 (Determine 2). That corresponded to 12.9 mmb/d of US oil manufacturing—tight oil is about 55 p.c of whole output. Roughly 600 rigs are wanted to take care of 7 mmb/d of tight oil and 12.5 mmb/d of US manufacturing.

The horizontal rig rely is now 165 so it’s unavoidable that manufacturing will fall. The appreciable lags and leads imply that manufacturing decline can’t be anticipated to reverse till effectively into 2021 assuming that it begins to extend instantly. That received’t occur due to constrained budgets and low oil costs.

Determine 2. 600 tight oil rigs to take care of 7 mmb/d tight oil/12 mmb/d whole US output

Might tight rig rely was 207 so US decline to eight mmb/d by Q2 2021 is unavoidable. Manufacturing ought to enhance this summer season with shut-in re-activation then fall in This fall 2020.

US producers shut in most of their wells in Might as a result of oil costs had collapsed and storage had reached its limits. Tight oil manufacturing has fallen greater than 1 mmb/d to six.2 mmb/d and whole US output is round 10.5 mmb/d.

With the storage disaster now apparently averted and with considerably increased oil costs, most tight oil wells are being re-activated. Manufacturing ought to enhance till all shut-in wells are again on line after which, it can resume its decline.

Based mostly on rig rely evaluation, US oil manufacturing will most likely be about eight mmb/d by mid-2021 or greater than four mmb/d lower than peak November 2019 ranges.

Killer Decline Charges Require A number of Rigs

Decrease US crude and condensate manufacturing is unavoidable with rig counts the place they’re immediately. That’s as a result of tight oil decline charges are actually excessive.

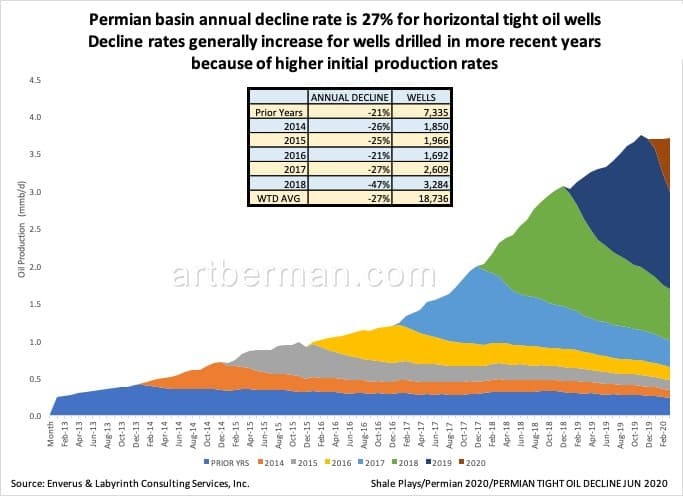

Determine three reveals Permian basin shale play decline charges by yr of first manufacturing. The typical of all years is 27 p.c per yr. Extra just lately drilled wells decline at increased charges due to higher drilling and completion know-how. The issue is that the wells don’t have better reserves—they only produce the reserves quicker. Meaning increased decline charges.

Determine three. Permian basin annual decline charge is 27 p.c for horizontal tight oil wells

Decline charges typically enhance for wells drilled in more moderen years due to increased preliminary manufacturing charges.

This isn’t a criticism of the performs or the businesses. It’s only a reality.

And that’s why it’s essential to maintain 500 or 600 rigs drilling on a regular basis—to switch the 30 p.c of output misplaced yearly to depletion.

Manufacturing will be turned on and off because it was in Might and June. Manufacturing can’t be elevated with out including rigs and drilling new wells. Assuming there was infinite capital obtainable so as to add rigs and drill wells, it might take a number of years to extend rig rely to ranges wanted to take care of 2019 output ranges.

Drilled, uncompleted wells (DUC) could also be introduced on to sluggish the speed of manufacturing decline considerably. It is very important be aware, nonetheless, that completion accounts for at the least 50 p.c of whole effectively price. Capital constraints and low oil costs will have an effect on the power and enthusiasm of corporations to finish DUCs.

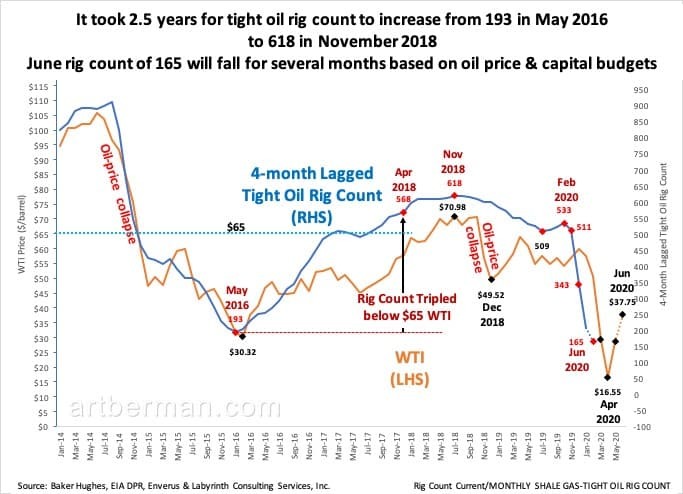

After the final oil-price collapse, it took 2.5 years for tight oil rig rely to extend from 193 in Might 2016 to 618 in November 2018 (Determine three). There have been 1000’s of DUCs over the last oil-price collapse in 2014-2017 however they didn’t have a lot impact on manufacturing decline.

The present June rig rely of 165 will proceed to fall for a number of months due to low oil value & capital budgets.

Determine four. It took 2.5 years for tight oil rig rely to extend from 193 in Might 2016 to 618 in November 2018

June rig rely of 165 will fall for a number of months primarily based on oil value & capital budgets.

Rigs Don’t Produce Oil, Wells Do

I’ve proven how rig rely, lagged manufacturing and decline charges are used to estimate future ranges of manufacturing. That method is helpful however the fact is that rigs don’t produce oil—wells do.

One other method, subsequently, is to match the variety of tight oil wells that had been drilled and accomplished throughout every of the final 5 years to the corresponding common manufacturing charges for every of these years. Then, utilizing year-to-date drilling and completion information, we will annualize and challenge what 2020 manufacturing is prone to be.

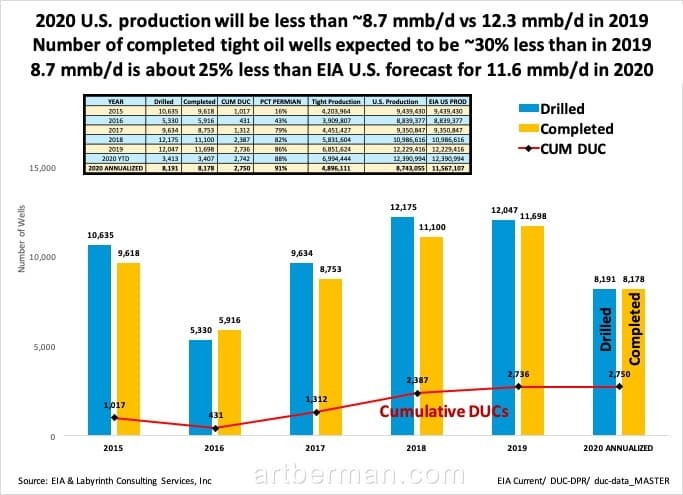

This method means that 2020 tight oil manufacturing might be about 30 p.c lower than in 2019 (Determine four). Since tight oil represented 56 p.c of whole US output in 2019, we might then estimate that US manufacturing will common about eight.7 mmb/d in 2020.

Determine 5. 2020 US manufacturing might be lower than ~eight.7 mmb/d vs 12.three mmb/d in 2019

Variety of accomplished tight oil wells anticipated to be ~30 p.c lower than in 2019. eight.7 mmb/d is about 25 p.c lower than EIA US forecast for 11.6 mmb/d in 2020.

That’s much like the estimate obtained from the rig rely method. It’s, nonetheless, about 25 p.c lower than EIA’s 2020 forecast for US crude & condensate manufacturing.

Vitality Dominance and Inexperienced Paint

A lot decrease US oil manufacturing is unhealthy for Trump’s Vitality Dominance anthem and its corollary that the US is vitality impartial. It’s even worse for oil costs and the US stability of funds as soon as demand recovers. We should import much more oil than we do immediately and it’ll price extra.

The thought of US vitality independence is ignorant at greatest and fraudulent at worst. The US imported almost 7 mmb/d of crude oil and condensate in 2019 and greater than 9 mmb/d of crude oil and refined merchandise. That’s nearly as a lot as China—the world’s second largest economic system—consumes.

The US is a internet exporter in the identical method that shale corporations are making large earnings—by accounting sleight-of-hand.

The US imports different individuals’s crude oil, refines it after which, exports it. If a rustic imports unpainted vehicles, paints them inexperienced after which exports them, is it a internet exporter of vehicles? No. It’s an exporter of inexperienced paint.

The US is screwed in the case of near- to medium-term oil manufacturing. It’s not due to Covid-19. US rig rely started to say no 15 months earlier than anybody had heard of Covid-19. Even when the street to financial and oil-demand restoration is quicker than I imagine will probably be, it can take a very long time to get again to 12 or 13 million barrels per day of manufacturing.

There are good causes to count on that a lot decrease US oil manufacturing will ultimately result in increased oil costs. That will lead to renewed drilling and one other cycle of over-supply and decrease oil costs. That’s how issues have developed previously.

However a brand new part of financial actuality and oil pricing is unfolding and nobody is aware of the place it can lead. Decrease demand might imply that decreased US oil output is suitable. The one factor that appears sure is that the US won’t be the oil tremendous energy it was earlier than 2020.

By Arthur Berman for Oilprice.com